The Marban Alliance property is located in the western portion of the province of Quebec, Canada, midway between the towns of Val-d’Or and Malartic and is comprised of 65 mining claims covering 2,189 hectares.

Exploration conducted at the Marban Alliance property apparently dates back to at least 1940 and includes geologic mapping, sampling, compilation of geological, structural, and geochemical data, geophysical prospecting, trenching, and extensive drilling from the surface and underground. At least 14 different companies explored and/or mined on parts of the property from 1940 through 2019 when O3 Mining was created. The deepest drill hole reached 1,475 vertical metres.

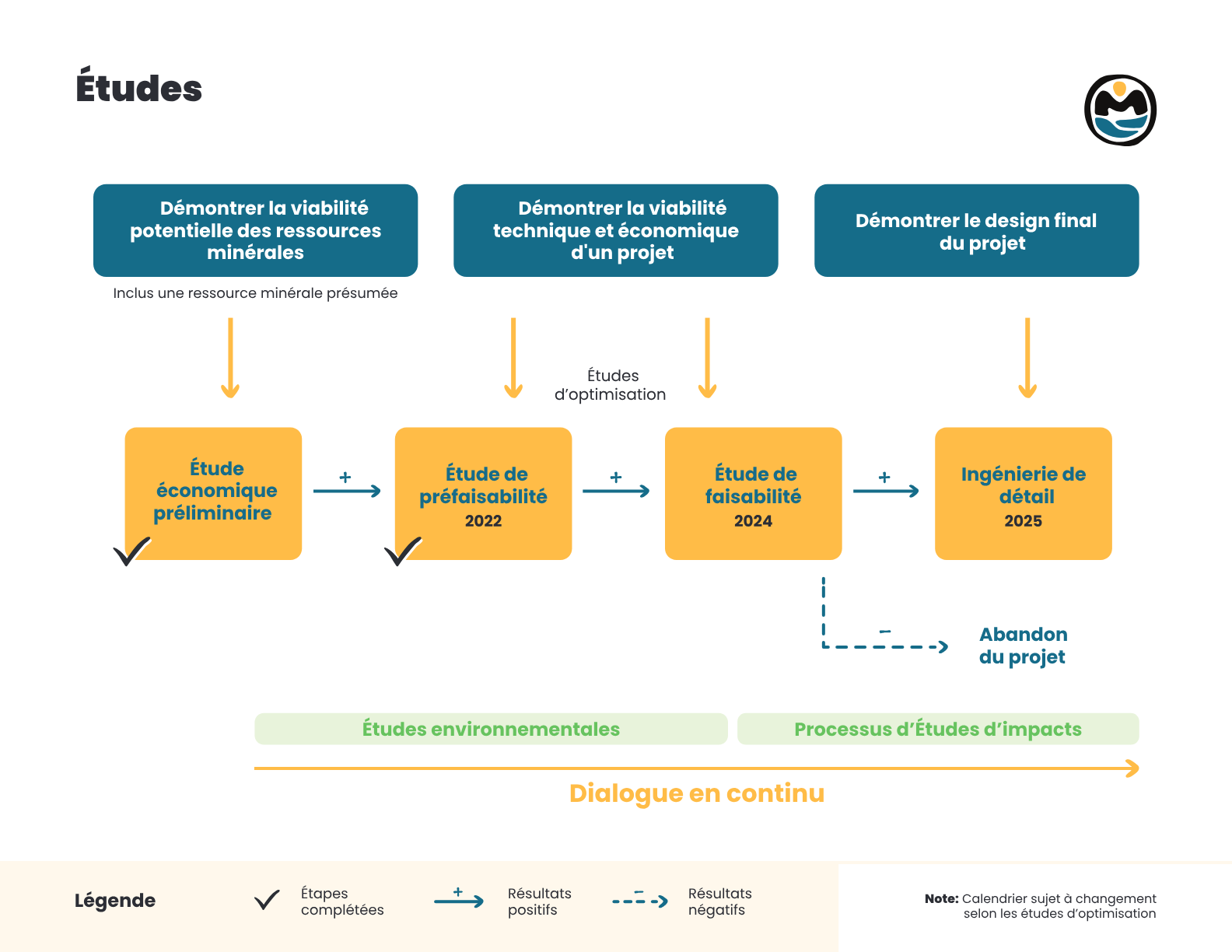

Marban Alliance was the object of multiple technical studies during is development including a Preliminary Economic Assessment (PEA) in 2020 and a pre-feasibility study (PFS) in 2022.

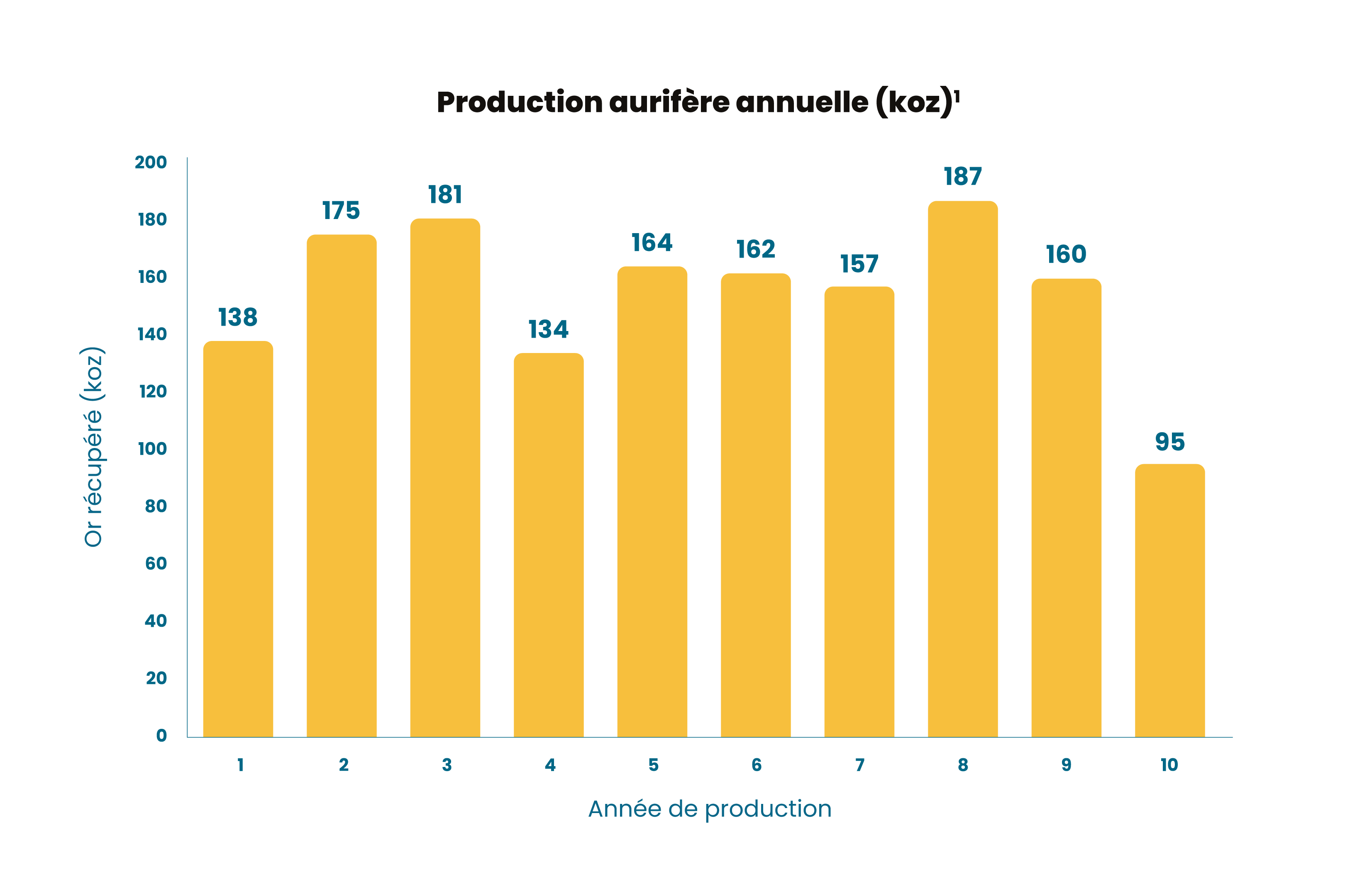

The project is developed as a stand-alone operation with all necessary infrastructure, including mining open pits, gold milling plant, tailing facilities, waste and overburden stockpile and all necessary access and production roads. The life of mine of the mining project is planned for 9.6 years of production at an average of 161 000 ounces per year.

Note :

1/ Please refer to the PFS of Marban

Ausenco Engineering Canada Inc. prepared a PFS for O3 Mining with an effective date of August 24, 2022. The project presents robust economics: Post-tax net present value (using a 5% discount rate) of C$463 million and a post-tax unlevered internal rate of return of 23.2% using a long-term gold price of US$1,700 per ounce and an exchange rate of C$1.00 = US$0.77.

The Marban Alliance property lies within the Archean Abitibi greenstone belt of the Superior Province, which consists of alternating east-trending metavolcanic-plutonic and sedimentary belts bounded by crustal-scale faults. The Marban Alliance property is subdivided into the Malartic Group, plume-derived komatiitic-tholeiitic marine-plain volcanic assemblages divided from north to south, into the La Motte-Vassan, Dubuisson, and Jacola formations and the Louvicourt Group representing an arc-type complex subdivided into the Val-d’Or Formation, a transitional to calc-alkaline volcanic complex, and the Héva Formation, characterized by geochemically distinct iron tholeiites.

The metavolcanic rocks within the Marban Alliance property are cut by three major northwest to west-northwest-striking auriferous shear zones of regional extent — the Marbenite, Norbenite and North and shears. The Marbenite shear hosts the Marban deposit, while the Norbenite shear hosts both the Kierens and Norlartic gold deposits and the North shear hosts the North zone.

The property hosts at least two types of gold mineralization. A first related to the major shears of the property, namely Marbenite, Norbenite, and North shears. Those shears are also related to the Kiena and Goldex deposits. Along those shears, the mineralization consists of quartz and quartz-carbonate-chlorite veins and veinlets within mafic and intermediate rocks. The thickest quartz veins of this type contain angular fragments of the host rocks. Alteration of the host rock consists of albitization, carbonatization and chloritization, whereas tourmaline is absent. This style of mineralization is common, regardless of the host rocks, in the Marban, Norlartic, Kierens, North, and Orion deposits. Sulphide content is generally below 2%, disseminated in the wall rock. At the Marban and Orion deposit the veins and veinlets are mainly hosted within an iron-rich basalt and are either transposed along the main schistosity or folded. At a larger scale, those deposits were concentrated along subhorizontal early fold hinges, a folding event that pre-date the main deformation event, in the southern Abitibi region, which is related to the penetrative subvertical schistosity and associated subvertical folds. At Norlartic and Kierens, the veins and veinlets are hosted intermediate dykes and are less deformed possibly due to a more competent host rock. Couture et al. (1994) and Bertrand-Blanchette (2016) have documented mineralization cut by tonalitic intrusions dated at 2692 ± 2 Ma for Norlartic and 2680 ± 1 Ma for Orion. The implication of these relative and absolute timing is that at least part of the mineralization is older than the main deformation event recorded in the southern Abitibi region. Although the mineralization shares multiple characteristics of orogenic gold deposits, namely the association with major shears, the carbonite and albite alteration and the lack of significant base metal or silver content, the deposits are much older than the orogenic gold deposits of the Val-d’Or mining district (Sigma-Lamaque and others). They can therefore be classified as pre-main deformation or early orogenic gold deposits.

The second mineralization type is related to tonalitic and granodioritic intrusions that cut the early mineralization. The best example is the North-North Zone hosted within a tonalitic intrusion. This zone consists of quartz–carbonate–tourmaline veins surrounded by albite alteration halos. They are very similar to the vein systems found in the Sigma-Lamaque and Goldex mines. The veins are spatially associated with discrete shear but the veins themselves are relatively undeformed. The same kind of gold-bearing veins is also found within the felsic intrusion south of the Norlartic deposit dated at 2692 ± 2 Ma (Couture et al., 1994). Like Sigma-Lamaque this mineralization event is classified as orogenic gold mineralization.

The Marban Alliance mineral reserves are distributed in two areas. The main open-pit Mine is the Marban Pit and represent 73% of projected production. The second area consists of 5 smaller pits including the Norlartic Pit representing 27% of the projected production.

Mining is planned as typical truck and shovel operation with 100 and 150 tonnes truck and 12 and 16 m3 shovels.

Marban Alliance’s mining reserves are distributed in two distinct areas. The first area, consisted by the main pit of the Marban Alliance mining project, accounts for 73% of projected production. The second sector it consisted by 5 separate pits, including the Norlartic pit, which represents the project’s secondary pit. Four other small satellites pits are presents in the sector. The second sector representing 27% of projected production.

At the pre-feasibility study stage, mining is planned according to typical open pit mining methods, i.e. using standard rigid mining trucks with loading capacities of 100 and 150 tonnes. In addition, the production shovels also meet these same industry standards via the use of 12 and 16m3 hydraulic shovels.

Marban Alliance milling capacity is planned at 6 Mt/year. The milling process includes crushing, grinding, cyanide leaching, carbon recovery and a tailing thickener. The overall rate recovery is estimated over 94%.

The Marban-Alliance project includes a stockpile area for waste rock from the pits, as well as a temporary overburden stockpiles. Note that the term temporary is used to specify that the overburden will be reused for mine reclamation at the end of the life of mine.

Two distinct tailings facility are planned to reduce the project footprint and visual impacts. A started wet tailings facility will be used for the first 3.5 years of production. For the following years, secondary Norlartic pit will be used for in-pit tailing deposition.

Since the creation of O3 Mining in 2019, exploration work on the Marban property has focused mainly on delineation, expansion and exploration drilling. As of May 2023, a total of 146,112 metres in 549 holes have been drilled at Marban Alliance. In May 2021, an air-borne drone magnetometric survey covered the Camflo, Orion, Malartic Hygrade, and Malartic H areas. Vision 4K inc. performed the survey using the AIM-LOWTM system.

The latest Mineral Resource Estimate for O3 Mining’s Marban and Kierens-Norlartic deposits was prepared by G Mining Services Inc. with an effective date of February 27, 2022. The lower cut-off grade for reporting the Mineral Resource is 0.30 g/t Au based on a recovery of 93.7%, processing + G&A costs of C$18.2/tonne, mining cost of $2.40/tonne and a gold price of US$1900/oz. The underground resource has been filtered manually to remove isolated blocks and has been reported using a 3.0 g/t Au lower cut-off for Marban, and a 2.5 g/t Au lower cut-off for Kierens-Norlartic. At these cut-offs, the total Indicated Mineral Resource is estimated at 67.7 million tonnes (Mt) at a grade of 1.09 g/t Au for a total of 2.37 million ounces (Moz), and Inferred Mineral Resource is estimated at 3.1 Mt at a grade of 2.21 g/t Au for a total of 0.22 Moz.

Additionally, O3 Mining continues with a brownfield exploration program on Marban Alliance including the expansion of all lateral extensions of the near-surface mineralization, to unlock the potential in the Malartic H and Hygrade Fold area as well as the downdip extension of the Marban deposit. The Malartic H deposit consists of multiple stacked lenses starting at surface and covering an area of 600 metres along strike by 300 metres wide along the Marbenite shear, which suggests a potential for a near-surface deposit that could extend the life of the mine. Most of the historical drilling was completed by NioGold Mining Corp. and Aur Resources Inc., with QA/QC procedures applied and documented. The O3 Mining 2023 winter infill drilling program on the Malartic H deposit comprised 23 drill holes totalling 6,948 metres. O3 Mining expects to release a maiden mineral resource estimate on the Malartic H deposit by the end of the second quarter of 2023. It is less 5 kilometres from the proposed processing plant described in the PFS. At Hygrade Fold, significant results from the 2022 campaign warrant follow-up drilling, namely 5.7 g/t Au over 7.6 m in hole O3MA-22-341, including 30.9 g/t Au over 1.2 m and 20.5 g/t Au over 2.2 m in hole O3MA-22-351, including 73.5 g/t Au over 0.6 m. Elsewhere on the property, other significant drill intercepts warrant follow-up drilling.

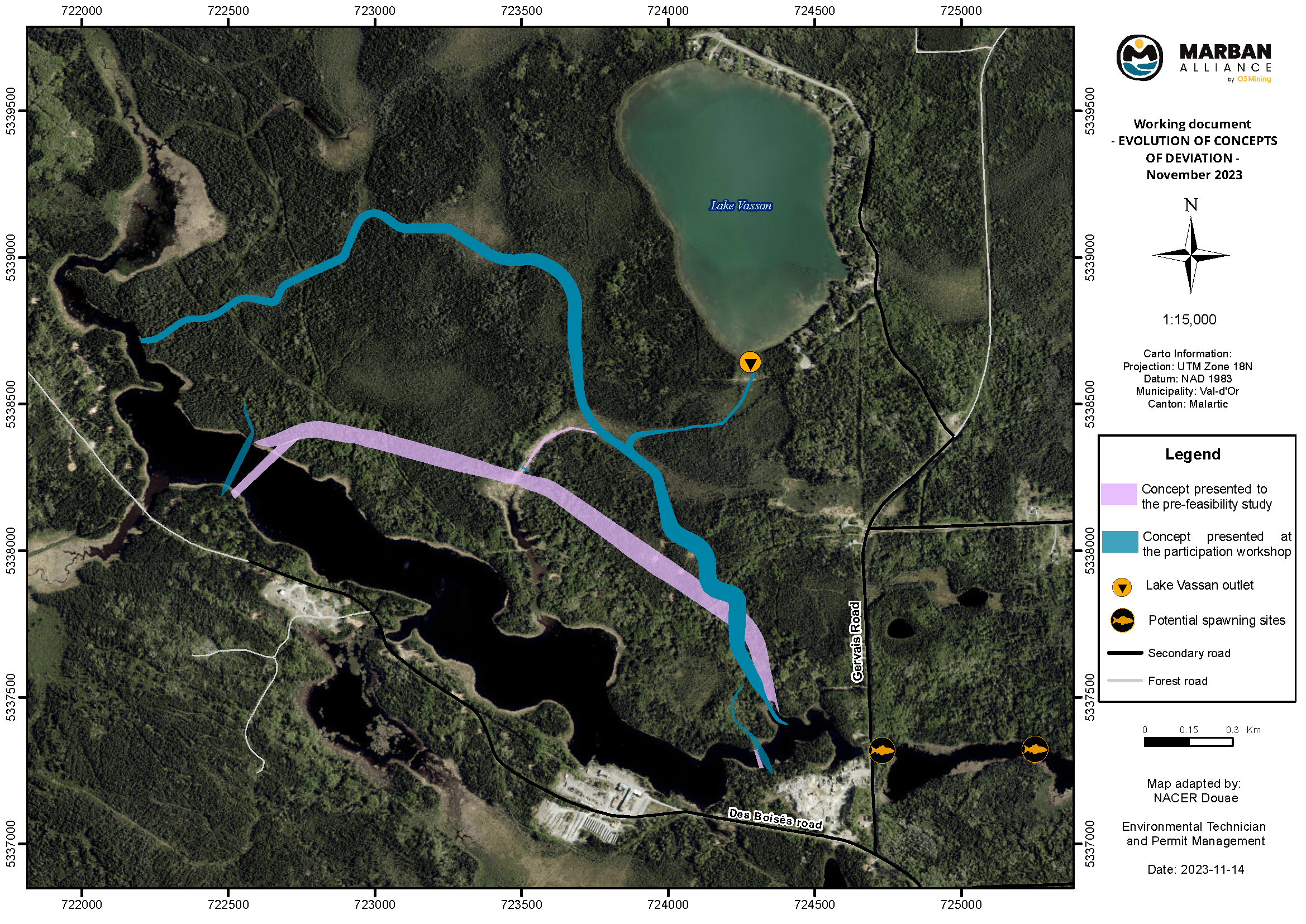

The Marban Alliance project includes the deviation of the Keriens Creek. A new concept for the deviation presented to the host community of Val-d’Or and Malartic. This step is part of the process of reducing the apprehended impacts and optimizing the Marban Alliance project announced June 27, 2023 in the press release, which will be part of a detailed assessment during the upcoming feasibility study.

The updated concept (see Figure 1) will be a permanent deviation that will maintain the current flow and allow the creation of an environment conducive to flora and fauna. This concept is not a final concept, various alternatives to the layout will be analyzed on the basis of stakeholder comments, on-going and planned studies.

Figure 1: Evolution of Deviation Concepts

As part of the environmental studies currently underway, an initial characterization study of the Keriens Creek sediments has been carried, out as well as characterization of the water. Initial data shows an impacted area. Mainly present in surface sediments, the study results show the presence of metals, sulfur and certain hydrocarbons. Further characterization studies are planned for 2024 to learn more about the state of the creek. Geotechnical studies at the proposed deviation site are also planned.

The Marban Alliance project is being developed in an area with a history of mining activities, in addition to other industrial activities. Between 1940 and 2019, fourteen (14) companies mining operated in the area. Marban Alliance is therefore located in a brownfield area which historical contamination is expected to be encountered. If the Marban Alliance project proceeds to construction, the legacy contamination of the sector will need to be addressed.

The Keriens creek deviation is an integral part of the Marban Alliance project as it relates to mining the deposit. No mining infrastructure other than pits is planned at this location. The deviation considers five pits (Kierens, Norlatic and satellites), the management of accumulated residues around and in the Keriens Creek, and the construction of dams.

The O3 Mining team is committed to continuing its collaborative efforts with citizens, elected municipal officials, Indigenous communities, provincial and federal government representatives, environmental groups, and partners. The comments from the different groups are essential to the improvement of the deviation layout.

Exploration conducted at the Marban Alliance property dates to 1940. At least 14 different companies explored and/or mined on parts of the property from 1940 through 2019 when O3 Mining was created. The Marban Alliance project foresees the reopening of the former Marban, Norlartic and Kierens mines.

| Mines | Compagnies | Years |

|---|---|---|

| Marban | Marban Gold Mines | 1961 to 1974 |

| Norlartic and North-North | Norlartic Mines | 1959 to 1966 |

| Resources Aur | 1990 to 1992 | |

| Kierens and Gold Hawk | Norlartic Mines | 1965 to 1966 |

| Resources Aur | 1988 to 1992 | |

| Malartic Hygrade | Malartic Hygrade | 1962 to 1963 |

| Camflo (on Marban property) | Barrick | 1981 to 1992 |

| Orion No 8 | Malartic Hygrade | 1987 to 1990 |

O3 Mining became the owner of the Marban Alliance project upon its establishment in 2019.

O3 Mining sustainable development objectives revolve around five pillars: Health & Safety, Environment, Talent & Culture, Host Communities and Governance. O3 Mining rigorously complies with the laws and regulations in effect in the jurisdictions where we operate. We are committed to respecting the environment, the health and safety of our employees and the general population, while taking into consideration the concerns of the host communities where we operate. O3 Mining strives to generate wealth and opportunities for its shareholders and long-term benefits for the host communities.

O3 Mining’s health and safety (“H&S”) culture is an integral part of our corporate culture to protect our employees, communities, and our key stakeholders. We strive for continuous improvement by reviewing our commitments and objectives annually, collecting and analyzing statistics, conducting audits, developing plans and targets to improve performance and making changes when appropriate to increase the safety of our operations. We pride ourselves on H&S being embedded in all our activities as outlined in our H&S Policy.

At O3 Mining, we conduct our activities respecting the environment in which we operate. Having an effective environmental strategy is an integral part of the success of our projects in how we execute day-to-day activities and strategic planning to create long-term value. We work to remain compliant with environmental laws and regulations while we develop our corporate policies and best practices to address global challenges we face and to act in the fight against climate change.

Keeping in line with our business strategy, we are determined to maintain sustainable growth by ensuring the careers of our talent progress.

The team at O3 Mining, including employees and contractors, is essential to achieving our mission of being a premier gold exploration and developer creating long-term value for all our stakeholders.

The sustainability of our projects in Val-d’Or, Québec, is dependent on the collaboration with our key stakeholders which we aim to build long-lasting relationships based on trust and respect. Our Company is proud of operating in a world-class mining district and we have had the opportunity to showcase the merits of the region.

O3 Mining aims to hold the highest standards of ethics and corporate governance. The governance structure is essential to setting strategies, identifying, and managing risks and opportunities, and using an ethical approach to add to the Company’s competitive advantage.

We distinguish ourselves through our commitment to our six core values.

We promote and manage a health and safety culture in all our activities.

We work with honesty, transparency, and trust in everything we do. We embody our principles when working with colleagues, shareholders, communities, and other stakeholders.

We are committed in striving for excellence showing hard work, reliability, dedication, and discipline.

We treat everyone equally and honourably embracing diversity and different beliefs. We will conduct our activities respecting the environment and the communities in which we operate.

We pursue our vision as a united organization: one team and one family.

We hold everyone to a common expectation of responsibility, assuming our mistakes and learning from them.

O3 Mining ESG reports outline our performance on environmental, social and governance issues related to the Company’s project activities. These reports are intended to provide transparent disclosure of the Company’s progress and commitment to its five pillars of sustainable development: ethics and governance, workplace health and safety, environment, talent and culture, and community engagement.